🤔 The American Dream Is Rigged

Plus: Not All Doctors Keep You Alive, and More

Today we’re featuring Money Machine Newsletter.

It’s designed to help you become a smarter, independent investor with two things:

Market-beating stocks in a 5-min read. Picked by elite traders. Delivered weekly to your inbox pre-market.

Market, investing, and business insights from insiders and experts outside the mainstream media.

You won’t find the same watered down stock picks like other services. Nor will you find the same regurgitated mainstream media information here.

I’ll let Money Machine Newsletter take it from here…

This week’s market, investing, and business insights from insiders and experts outside the mainstream media:

The government calls it growth, most just call it rigged.

New study: patient survival isn't about experienced doctors.

Citadel’s MASSIVE bet no one’s talking about.

MAJOR car company might get pushed out—for tanks.

And more. Let’s get to it!

Top Insights of the Week

1. 🤔 The American Dream Is Rigged

Owning a home. Building wealth. Retiring comfortably. It used to be a given if you worked hard. Not anymore. Prices keep climbing, wages don’t, and the game feels rigged. The government calls it a strong economy. People call it rigged…

The stock market soared, and those who owned assets made a fortune. Homeowners who bought before 2020 saw their values shoot up. But new buyers are locked out, renters are sinking under rising costs, and Social Security is running dry.

The system isn’t just failing. It’s actively making things worse…

Government props up risky loans and limits new construction, keeping prices high.

Social Security trust fund is projected to be depleted by 2035.

The middle class got left behind. The wealthy own assets. Everyone else was told to "work hard and save." But saving doesn’t build wealth—owning does.

This can be fixed. But not with handouts, inflation, or wishful thinking. It takes a reset—one that puts real ownership back in the hands of everyday people…

Lower housing costs. Cut regulations that drive up prices. Stop subsidizing bad loans that inflate the market.

Reform Social Security. Shift retirement funds from low-return government bonds into the stock market, so all Americans share in the economy’s growth.

Give people skin in the game. A national investment fund that makes every citizen a shareholder in the country’s success.

The American Dream isn’t dead, just out of reach. The right changes could fix that. But if we do nothing, the gap widens, and people lose faith. This isn’t politics—it’s about opportunity.

2. 😳 Not All Doctors Keep You Alive

Not all doctors are equal. They all passed med school, got their white coats—but a new study says that’s wrong. Some are better at keeping you alive. The secret? Not experience. Not bedside manner. It’s their board exam score…

Here’s the thing… hospitals, educators, and policy makers have been shifting away from standardized tests…

Instead, they use milestone ratings—ongoing assessments during training. The idea? Real-world skills matter more than a test… not according to a new study.

This new study says board scores actually predict patient survival, and milestone ratings don’t…

If your doctor scored in the top 25%, your risk of dying within a week of hospitalization is 8% lower.

Your chance of being readmitted? 9% lower.

It analyzed 7,000 doctors across 455,000 hospitalizations.

Hospitals require board certification, but do they care about the score? Most patients never see it. And if the world shifts to competency-based training, do board exams even matter anymore?

Medical school promises every graduate is good enough. This study says otherwise. Some are just better.

What happens when we ignore the one metric tied to survival? And if you’re in the hospital… do you even get a choice?

3. 🤫 Citadel’s MASSIVE Bet No One’s Talking About

Everyone’s obsessed with the companies building AI, but they’re ignoring the ones powering it. Citadel’s Ken Griffin isn’t… he just made a $1.2B bet on something more critical than GPUs—and it’s not what you think… natural gas…

This isn’t just another hedge fund trade. It’s a structural shift in how the smartest money in the world is positioning for the next decade.

If Citadel is diving into natural gas, here’s what it likely means…

Energy demand from AI, manufacturing, and global industry is far outpacing supply.

Wind and solar won’t scale fast enough to keep up with the demand surge.

U.S. liquid natural gas is about to become one of the most valuable commodities on the planet.

Europe, shaken by geopolitics, has been racing to cut ties with Russian energy—with more liquid natural gas imports and new pipelines.

This isn’t a short-term bet. It’s a long-term thesis on the future of power…

Top investors aren’t just trading energy anymore—they’re buying it.

The next big winners know energy—not algorithms—powers AI. Right now, the market is mispricing natural gas. Citadel isn’t.

Top 3 Charts of the Week

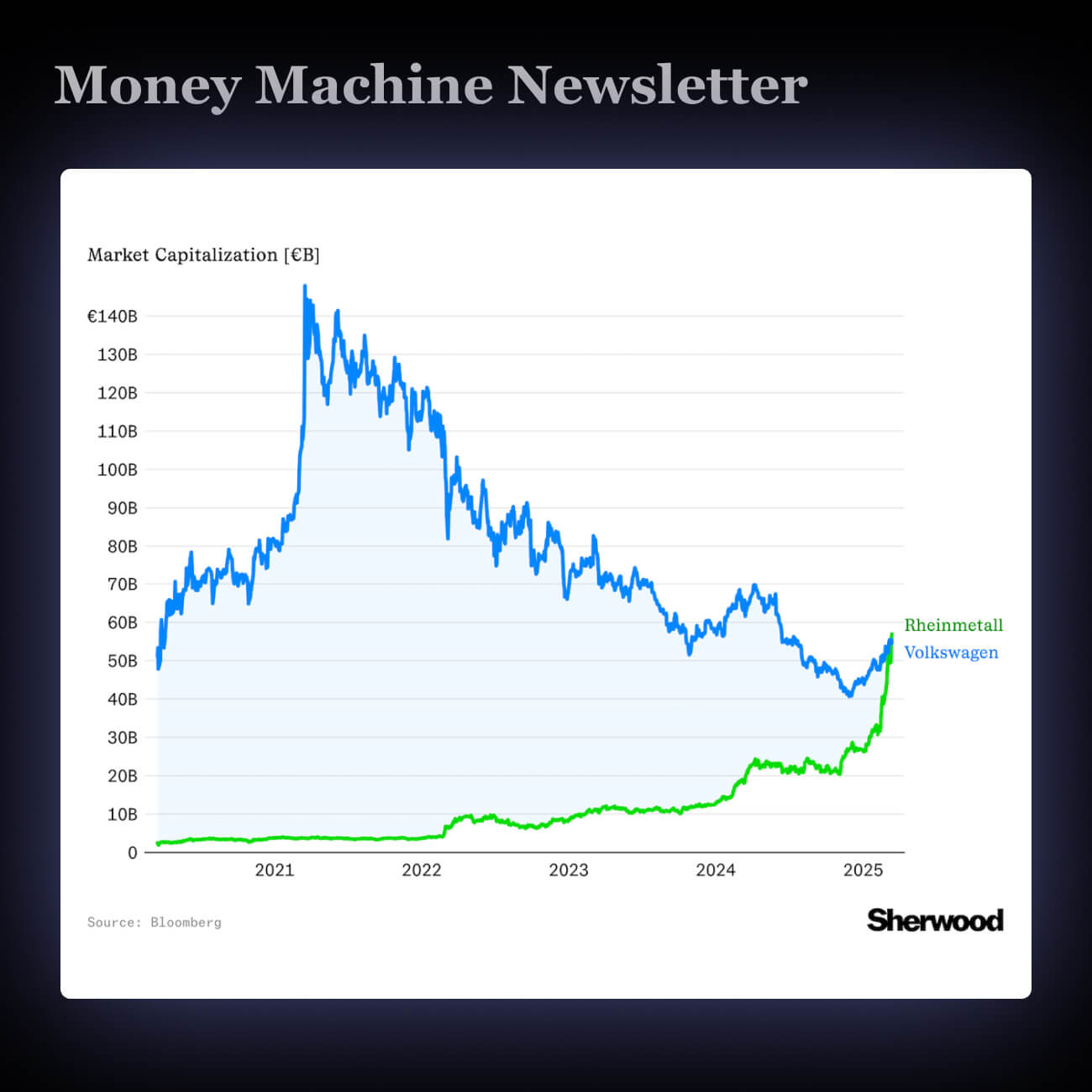

1. 🤯 Rheinmetall Overtakes Volkswagen in Market Value

Rheinmetall, a defense company that makes tanks and ammo, is now worth more than Volkswagen. Germany’s big defense spending boost is fueling its rise, while Volkswagen struggles against Chinese EV competition.

Germany is shifting from making cars to making tanks. Rheinmetall might even take over a Volkswagen factory to build military vehicles instead of EVs.

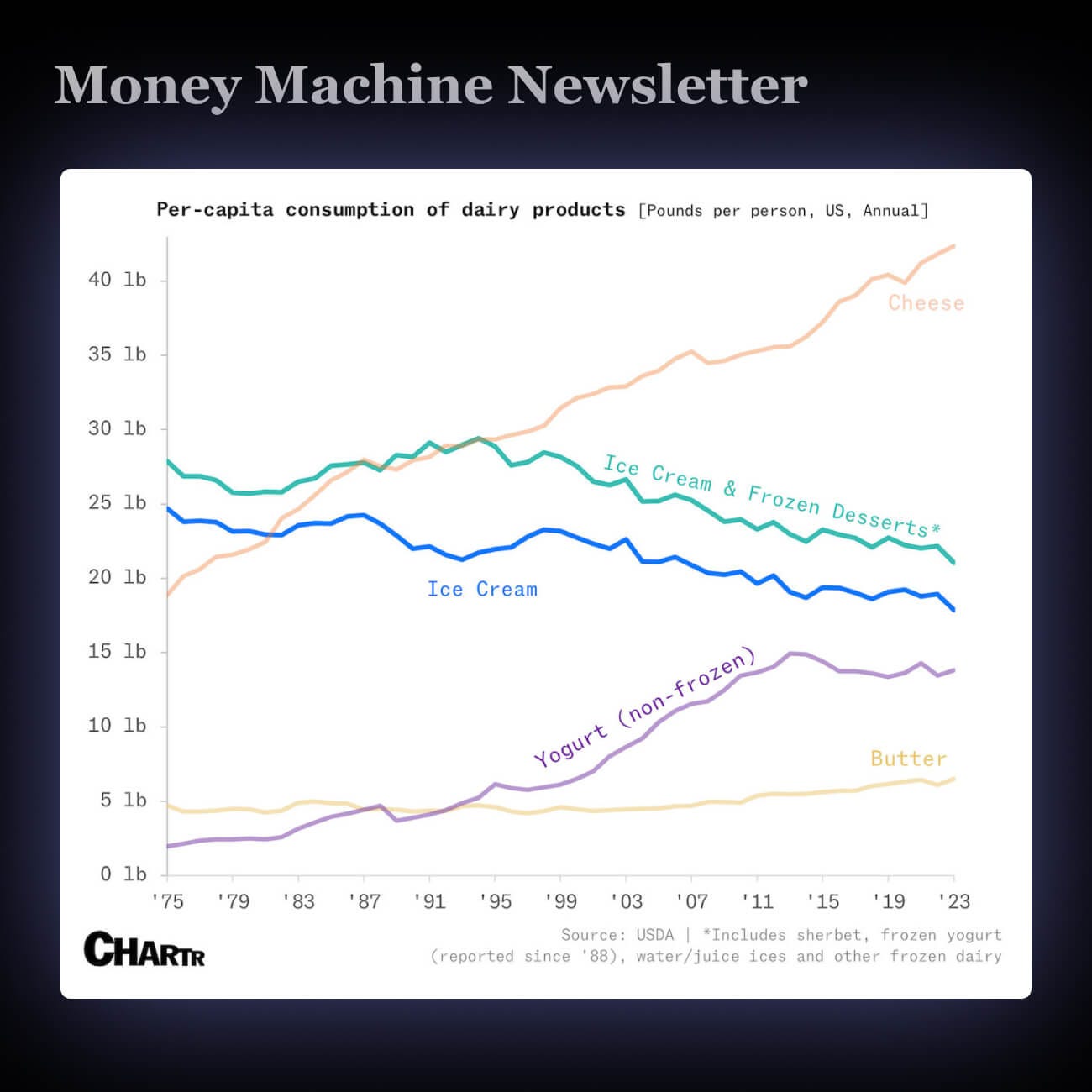

2. 🍦 Americans Are Eating Less Ice Cream Than Ever

Unilever, the world’s biggest ice cream maker, is selling off its $8.7B ice cream business.

Americans are eating less ice cream—USDA data shows a long-term decline. Health trends, lower sugar intake, and weight-loss drugs like Ozempic could push ice cream consumption down another 5.3% by 2035.

Unilever’s ice cream sales make up 13-14% of its revenue but drag down profits. It’s shifting focus to higher-margin products like personal care and condiments.

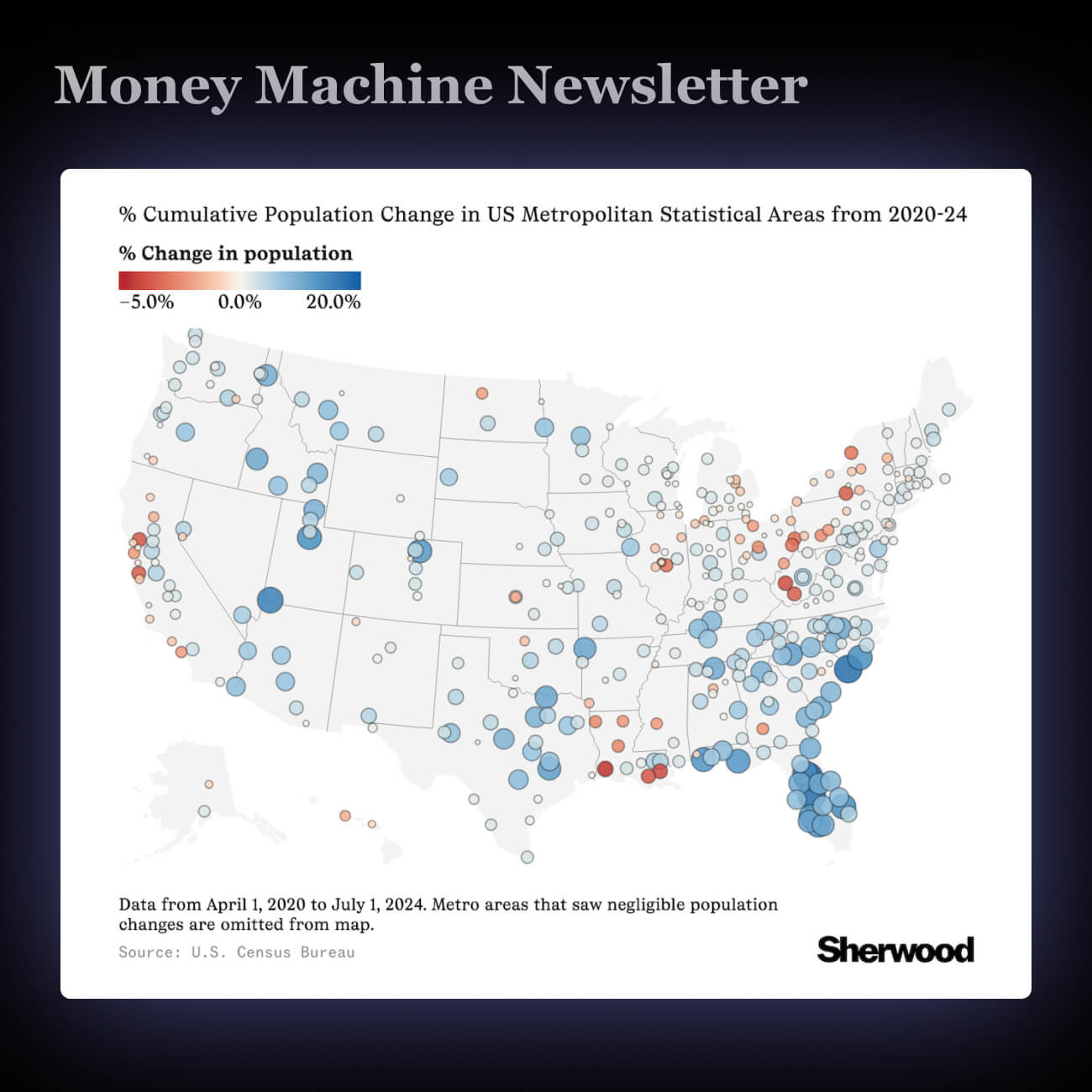

3. 😎 Cities Are Booming Again—And Florida’s Still the Top Destination

Cities are growing again. Metro areas gained 3.2M people from 2023 to 2024, with 96% of U.S. population growth happening in cities. Immigration drove most of the increase.

People are moving back to cities, reversing the pandemic trend. Florida, is still the hot spot, with 9 of the 10 fastest-growing metros.

Join 6,000+ self-directed investors who have already placed themselves on the path to greater wealth by making $500, $1,000, $2,000, $3,000, or more every month with Money Machine Newsletter’s trade ideas.

See you in there!

Best,

Money Machine Newsletter

Nothing in this email is intended to serve as financial advice. Do your own research.